The 118th Congress: When Doing Nothing Became an Art Form

Ladies and gentlemen, gather ’round as we recount the tale of the 118th Congress—a legislative body so inert, it makes a sloth look like an Olympic sprinter. In an era where action was desperately needed, our elected officials chose to perfect the ancient craft of doing absolutely nothing. Bravo! Let’s start with the numbers, shall […]

Brace for Impact: 2025’s Global Economy Could Be a Bumpy Ride

As we bid farewell to 2024, it’s time to dust off the crystal ball and peer into the murky waters of 2025. Spoiler alert: the forecast isn’t exactly sunshine and rainbows. According to Reuters, the global economy is gearing up for a year filled with challenges that could make even the most optimistic economist break […]

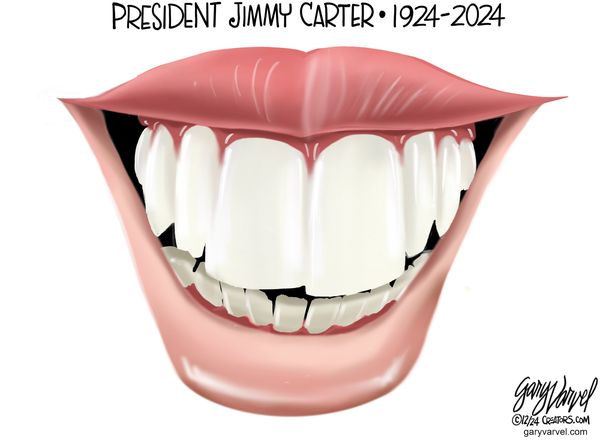

Jimmy Carter’s Final Departure: The Peanut Farmer Who Couldn’t Crack Washington

Well, it’s official. Jimmy Carter, the 39th President of the United States, has passed away at the ripe old age of 100. A centenarian! Quite an achievement for a man whose presidency barely made it past infancy. Carter, the humble peanut farmer from Plains, Georgia, who ascended to the highest office in the land, only […]

Trump’s Deportation Plan: Keeping Families Together… Abroad!

In a recent interview, President-elect Donald Trump unveiled a novel approach to immigration enforcement: deporting entire families, including American citizens, to avoid the heartache of separation. Yes, you heard that correctly. To keep families united, Trump suggests sending everyone packing—citizens and non-citizens alike. This plan, as reported by the New York Post, aims to prevent […]

Supreme Court Upholds Texas Voting Law: A Victory for Election Integrity or Just Common Sense?

In a move that should surprise absolutely no one paying attention, the Supreme Court has declined to review Texas’s age-based mail-in voting restrictions, effectively allowing the law to stand as is. For those unfamiliar with the specifics, Texas law permits only individuals aged 65 and older to vote by mail without a qualifying excuse, such […]

Biden’s FDA Decides They’re the Boss of Your Pantry Now

The FDA is at it again, swooping in to save us from ourselves with a shiny new definition of what qualifies as “healthy.” The agency seems to think Americans can’t grasp that salmon is a healthier choice than sugary cereal. It’s like they imagine us aimlessly picking up white bread and cartoon-covered yogurt, completely lost […]

Outrage Over Cancer Research Funding is Fake When Schumer Blocked the Bill

You’ve got to hand it to the Democrats—they’ll stop at nothing to cling to their bloated spending bills, even if it means weaponizing pediatric cancer research. Let’s talk about the hypocrisy here: earlier this year, Republicans in the House passed H.R. 3391, a bill focused on funding research into devastating pediatric diseases like childhood cancer. […]

Why Singing Christmas Carols Is a Patriotic Act

Ah, Christmas carols. Those delightful tunes that make even the grouchiest among us tap their feet and hum along. But did you know that belting out “Silent Night” or “O Come All Ye Faithful” is more than just a festive pastime? It’s actually one of the most patriotic things you can do this holiday season. […]

Biden’s Bird Flu Policies Are Plucking Small Farms Dry

Under the Biden administration, the government’s bird flu testing policies are creating a nightmare for small farmers across the country. What started as a measure to control avian flu outbreaks has spiraled into an overreaching system that unfairly targets small, family-run farms while leaving corporate agricultural giants relatively unscathed. For many small farmers, this isn’t […]

Why Are Democrats Desperate to Hide This Green Energy Investigation?

Oh, look, more attempts at playing hide-and-seek with taxpayer dollars. Democratic lawmakers are now in full damage-control mode, trying to derail a federal watchdog investigation into the Biden administration’s $400 billion green energy loan program. And why? Because this long-running probe seems to be uncovering some less-than-flattering truths about how the Loan Programs Office is […]

Two Virginia Democrats Wave Goodbye: A ‘Mission’ Abandoned in Chaos

Well, isn’t this rich? Two Democratic women from Virginia who rode the so-called “blue wave” to Congress in 2018 are now packing up and heading home, just as the political tides are turning. Abigail Spanberger and Jennifer Wexton came to Washington with big dreams and lofty promises, but as their terms come to a close, […]

Blinken’s Backchannel: U.S. Diplomacy or Another Middle East Mess?

So, it turns out that U.S. officials have been quietly chatting with the Syrian rebel group that just ousted President Bashar al-Assad. That’s right—our government, under the steady hand of Secretary of State Antony Blinken, has been playing diplomat with a ragtag band of insurgents who, as of last week, were busy toppling a dictator. […]

China’s Stimulus Game: Printing Prosperity or Just Buying Time?

You’ve got to hand it to China. When the chips are down, and their economy is looking shakier than a Jenga tower in a windstorm, Beijing doesn’t sweat it—they just print more money and call it a strategy. In the latest round of economic acrobatics, China has ramped up its stimulus drive, signaling to the […]

Bomb Threat Politics: How Extremism Is Taking Over the Conversation

Another day, another bomb threat targeting a sitting member of Congress. This time, it’s Democratic Representative Lori Trahan of Massachusetts, whose family was the subject of a chilling and dangerous hoax. Authorities found no evidence of an actual bomb, but the incident adds to a disturbing trend: violence or the threat of it becoming part […]

Daniel Penny’s Verdict Exposes Alvin Bragg’s Justice-for-Some Agenda

Well, it seems justice has prevailed—or at least dodged the usual political spin. Daniel Penny, the Marine who stepped in during a violent subway altercation, has been found not guilty. But the story doesn’t end there. Instead of celebrating a fair verdict, Manhattan District Attorney Alvin Bragg now finds himself in the crosshairs. Critics are […]