The United States Steel Corporation was responsible for some of the most iconic moments in American history. Among them were the bombing campaigns across Nazi Germany and Imperial Japan to secure victory for the Allies in World War II. Now a survivor of that campaign, Nippon Steel, looks to buy out the United States Steel Corporation. Announced on December 18th, the deal is reportedly worth $15 billion.

Still needing the approval of shareholders, the company’s attempted to calm concerns concerning the merger from the jump. Pledging to maintain the full code of conduct and other bits in the current contract for US steel employees, they each immediately entered into damage control. For good reason, too.

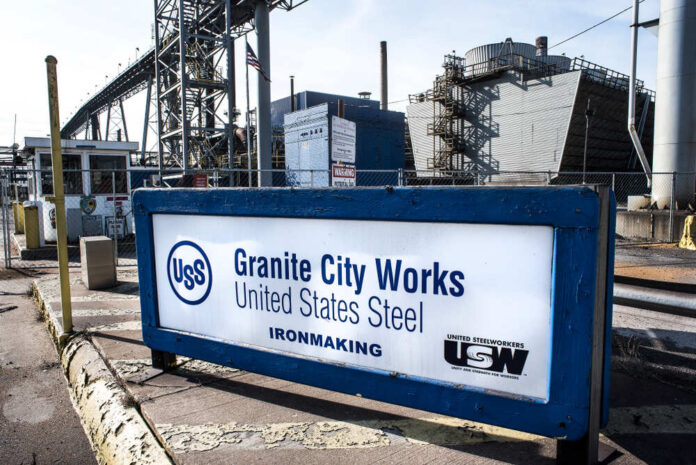

As the US Steelworkers (USW) union led by David McCall looks at this decision, the statement he released doesn’t sound like this deal was done in good faith. As he described the greedy attitudes of US Steel, it became apparent that the company would sell out at all costs.

“We remained open throughout this process to working with U.S. Steel to keep this iconic American company domestically owned and operated, but instead, it chose to push aside the concerns of its dedicated workforce and sell to a foreign-owned company. Neither U.S. Steel nor Nippon reached out to our union regarding the deal, which is in itself a violation of our partnership agreement that requires U.S. Steel to notify us of a change in control or business conditions.”

A violation of their contract like this could put a kibosh on the whole deal. With McCall questioning just how much of their contract Nippon has read, much less understands, there is a lot left to be said for the way this deal was executed. If anything, it leaves a lot up in the air.

McCall’s statement continued, “This includes not just the day-to-day commitments of our labor agreement but also significant obligations to fund pension and retiree insurance benefits that are the most extensive in the domestic steel industry. Our union intends to exercise the full measure of our agreements to ensure that whatever happens next with U.S. Steel, we protect the good, family-sustaining jobs we bargained for. We also will strongly urge government regulators to carefully scrutinize this acquisition and determine if the proposed transaction serves the national security interests of the United States and benefits workers.”

In conclusion, McCall vowed that the USW would hold the company to the terms of their agreement without reservation; this could easily mean the end of this deal. Given the sheer number of deals the USW has brokered around the world on behalf of the companies and their employees, it’s wrong to leave them out. Unlike in Japan, where unions are so common that they are almost comical, here in the US, they have serious power, and that power is not only respected but enforced.

Founded in 1901 by Andrew Carnegie, J.P. Morgan, and Charles Schwab, the company did not take long to become part of the fabric of America. While it certainly made these three men incredibly rich, it also quickly became a significant part of the fabric of America. Assuming its role as the chief industry in WWII, the company was the crown jewel in the “Arsenal of Democracy” in WWII. It was in this role that Pennsylvania (particularly Pittsburgh) became widely known for its incredible steel production.

Selling this off to a Japanese company like Nippon is a horrific decision. It strips away yet another part of the Industrial Revolution. Given all that these companies gave to the American people, it should be downright illegal to sell off such a corporation. As it stands, we have watched the problems arise from farming things out to foreign interests, even if it’s just for parts to “assemble” the piece in the US.

Executives from US Steel should be embarrassed. More than anything else, this simply serves to undercut American workers and American self-reliance in the face of consistently growing adversity.